Money in a Relationship and its Effect on Romantic Dynamics

Money is never just money in a relationship.

It’s security, power, gratitude, fear, pride, childhood wounds, and future dreams all rolled into one bank account. That’s why couples can argue more about ₦5,000 / £20 than about cheating – because the argument isn’t about the amount, it’s about what the money means.

In this post, we’ll unpack how money shapes romantic dynamics, the hidden stories we carry about it, and how couples can handle money in a way that deepens connection instead of quietly destroying it.

1. Why money is such an emotional topic

Most of us grew up seeing money handled in particular ways:

-

Maybe one parent controlled all the money and used it to control everyone else.

-

Maybe there was never enough, so every spending decision now feels like a threat.

-

Maybe you were told, “A man MUST provide,” or “A woman who earns too much will chase men away.”

We don’t drop those beliefs at the door when we fall in love. We bring them into the relationship – often without realising it.

So when your partner says, “Why did you spend that much?”, you might hear:

-

“You’re irresponsible”

-

“I don’t trust you”

-

“You’re not a real man/woman/partner”

even if that’s not what they meant.

2. Income gaps and power balance

Money often affects who has more power in a relationship.

When one partner earns much more

If Partner A earns significantly more than Partner B, a few patterns can show up:

-

Parent–child dynamic: The higher earner starts “allowing” or “approving” purchases like a parent; the other feels like a child asking for pocket money.

-

Guilt vs resentment:

-

The higher earner may feel pressure to always pay, even when they’re tired or stressed.

-

The lower earner may feel ashamed or defensive, and over-compensate in other areas (housework, emotional labour, etc.).

-

-

Decision power: Big life decisions (where to live, when to have kids, whether to relocate abroad) start to follow the wishes of the person with more financial power.

This doesn’t mean couples with income differences are doomed – but it does mean they need to talk openly about expectations and respect.

When the woman earns more (or is more financially stable)

In many cultures – including Naija and the diaspora – people still expect men to “provide.” When a woman earns more, both partners can feel pressure:

-

He may feel his masculinity is under attack.

-

She may downplay her success, hide achievements or apologise for her income.

-

Extended family may make comments like, “She is controlling him because she has money,” or “He’s a gold-digger.”

If a couple doesn’t address this honestly, insecurity can turn into power games, cheating, or quiet resentment. Healthy couples reframe it as, “Our money, our team advantage,” rather than a threat to gender roles.

3. Different money personalities

Even if two people earn the same, their money personalities can clash:

-

The Saver: Loves security, hates debt, feels safe seeing money sit in the account.

-

The Spender: Believes money is to be enjoyed, not just looked at.

-

The Planner: Thinks in budgets, goals and spreadsheets.

-

The Avoider: Feels anxious with numbers and prefers not to look.

In a relationship, these opposites often attract – and then annoy each other:

-

The Saver calls the Spender “wasteful.”

-

The Spender calls the Saver “stingy” or “controlling.”

-

The Planner complains they’re the only one who “cares about the future.”

-

The Avoider is tired of every date night turning into a financial lecture.

The problem usually isn’t the personality itself, but the lack of shared rules and mutual respect.

4. Joint, separate or “hybrid” accounts?

There is no one “correct” way to structure money in a relationship, but each setup affects dynamics differently.

A. Everything joint

All income goes into one shared account; bills and spending come out of it.

Pros

-

Strong sense of “we’re a team.”

-

Easier to see the full financial picture.

-

Simpler for long-term planning (mortgage, kids, etc.).

Risks

-

One partner can feel watched or controlled.

-

If trust breaks (e.g. secret spending), the damage is huge.

-

Hard for each person to have a sense of financial independence.

B. Entirely separate

Each partner keeps their own account and agrees how to split bills.

Pros

-

Clear independence – no one feels like they need permission to buy things.

-

Useful when incomes differ a lot or when one person has heavy debts.

Risks

-

Easy to slip into “roommate” energy – everything becomes 50/50 maths, not “our life.”

-

May hide financial problems from each other, leading to surprises later.

C. Hybrid approach (very popular)

-

One joint account for shared bills (rent, food, kids’ expenses).

-

Each partner keeps a personal account for their own spending.

-

People often contribute by percentage, not 50/50 (e.g. each person puts in 40% of their income).

This can balance teamwork with autonomy – as long as both people agree the split feels fair.

5. Debt, black tax and hidden pressure

Two realities many couples face but rarely talk about:

-

Debt – student loans, credit cards, business loans, bride price loans, etc.

-

Black tax / family obligations – sending money home every month, paying siblings’ fees, helping parents with rent or hospital bills.

Both can seriously impact romantic dynamics if they’re kept secret or dismissed.

-

The partner without debt may feel “punished” for being responsible.

-

The partner with heavy family obligations may feel misunderstood or judged.

-

Arguments arise when one person doesn’t respect that family support is non-negotiable for the other.

Healthy couples:

-

Share a full picture early enough (not on the wedding day).

-

Agree together how much goes to debt/family support.

-

Treat those commitments as part of the shared reality, not “your problem.”

6. Red flags in money behaviour

Some financial behaviours are not just differences in style; they’re potential red flags:

-

Financial secrecy: hiding income, accounts, debts or major purchases.

-

Financial control: one partner uses money to punish, threaten or control choices (“If you leave, you’ll have nothing”).

-

Chronic borrowing with no plan: repeatedly taking money with no realistic intention to repay or contribute.

-

Gambling / addiction: repeated risky behaviours that damage shared finances.

-

Love-bombing with money: spending excessively at the start of a relationship, then later using that history to demand loyalty or obedience.

If you see these patterns, it’s important to set boundaries, seek advice, or in some cases, re-evaluate the relationship altogether.

7. Healthy money habits that strengthen love

Money doesn’t have to be a source of stress. Handled wisely, it can actually deepen trust and connection.

1. Have regular “money dates”

Once a month, sit down together (not during a fight!) and talk about:

-

What came in and what went out

-

Any surprises (big spends, bills, gifts)

-

Upcoming expenses (trips, school, rent increases)

-

One small financial goal you can work on together

Keep it short, kind and blame-free. Maybe do it over food or coffee so it doesn’t feel like punishment.

2. Use “we” language

Instead of:

-

“Your debt is stressing me.”

Try:

-

“This debt affects us – let’s look at how we can handle it together.”

Instead of:

-

“You spend too much.”

Try:

-

“I feel anxious when we spend more than we planned. Can we agree on a spending limit we both feel good about?”

3. Define “fair”, not just “equal”

At different stages of life, “fair” may not be 50/50:

-

Someone in school or starting a new business may contribute less financially but more in other areas.

-

If one person takes a break for childcare, the couple can talk about how to keep their long-term financial security intact (pensions, savings, etc.).

The key question is: “Does this feel fair to both of us?”, not “Is it exactly equal?”

4. Plan for dreams, not just bills

Money talks shouldn’t only be about stress. Include:

-

Shared goals: a trip, a business, a move, a wedding, a home.

-

Timelines: “In 6 months we’d like to…” or “In 3 years, our goal is…”

When money is connected to shared dreams, saving becomes less painful and more motivating.

8. Talking about money early when you’re dating

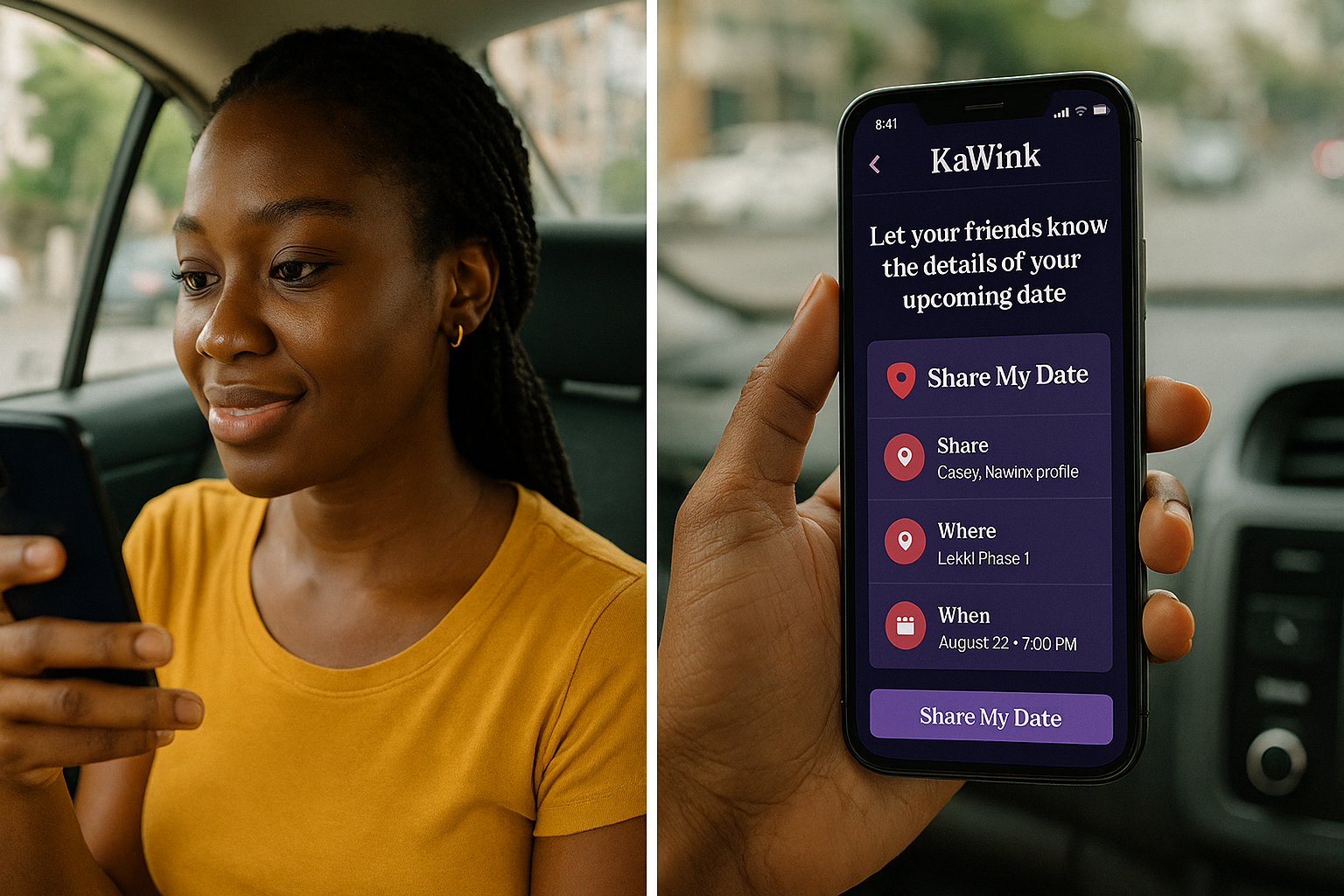

If you’re still in the dating stage (hello, KaWink 👀), you don’t need to send your payslip on the second date, but you can watch and gently ask about:

-

Their attitude to work and responsibility

-

How they talk about debt, savings and generosity

-

Whether your basic values match (e.g. “I love soft life” vs “I must build house first”)

Some light but honest questions:

-

“What does financial independence mean to you?”

-

“Are you more of a saver or a spender?”

-

“If money wasn’t an issue, how would you spend your time?”

If the other person can never talk about money at all or becomes aggressive when the topic comes up, take that seriously.

Final thoughts

Money will always touch romantic dynamics – from who pays for the first date to who signs the mortgage. The goal isn’t to find someone who thinks exactly like you, but someone who is:

-

willing to be honest,

-

willing to listen, and

-

willing to build a shared approach over time.

When couples treat money as “our tool” instead of “my weapon” or “your problem,” it stops being the silent enemy and starts becoming part of the love story.

If you’d like, I can turn this post into a shorter “Instagram carousel” or “KaWink blog summary” version with bullet points and hooks.